Temenos Blogs

Discover the latest insights, trends and innovations in banking technology with expert analysis, case studies and industry updates from Temenos.

Discover the importance of continuous banking transformation, including getting the foundations right, setting realistic expecta...

Temenos empowers banks with AI-driven smart defenses, boosting efficiency and staying ahead of financial sector threats.

Recent fair lending rule changes surprised many bankers and changed how agencies enforce anti-discrimination laws.

Temenos empowers banks to modernize tech, streamline workflows, and boost staff performance with AI, automation, and SaaS tools.

Discover how simplifying money movement in the attention economy accelerates time-to-value for both established institutions.

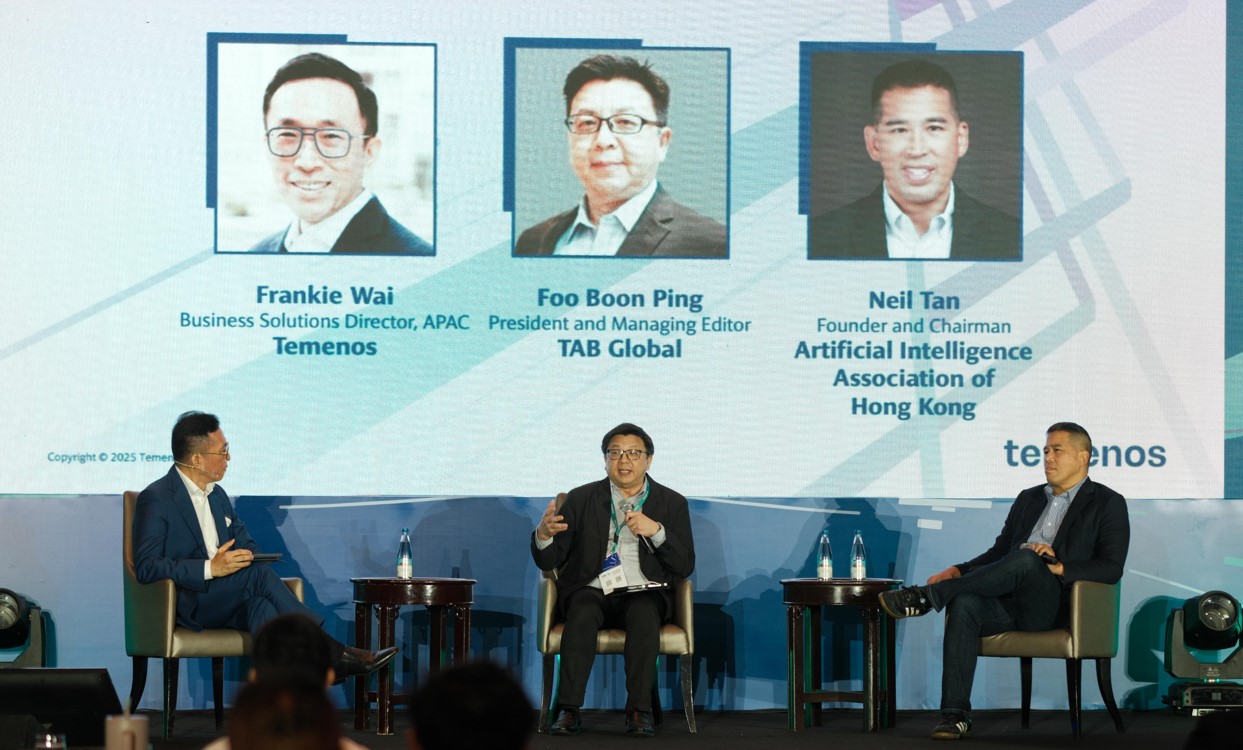

90% of banks in Asia Pacific are exploring AI to enhance human capabilities.

EastWest Bank’s Temenos cloud-native SaaS move shows how PH banks can scale and modernize for sustainable growth.